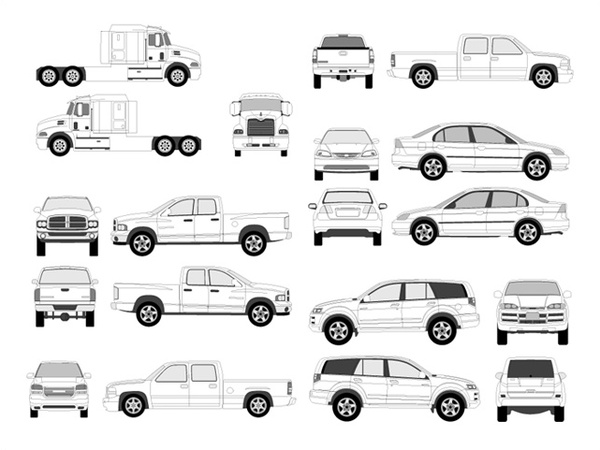

- Vehicle Outlines Free Vehicle Wrap Templates Illustrator

- Vehicle Templates Free Download

- Free Vehicle Outline Templates

- Free Vehicle Outline Templates

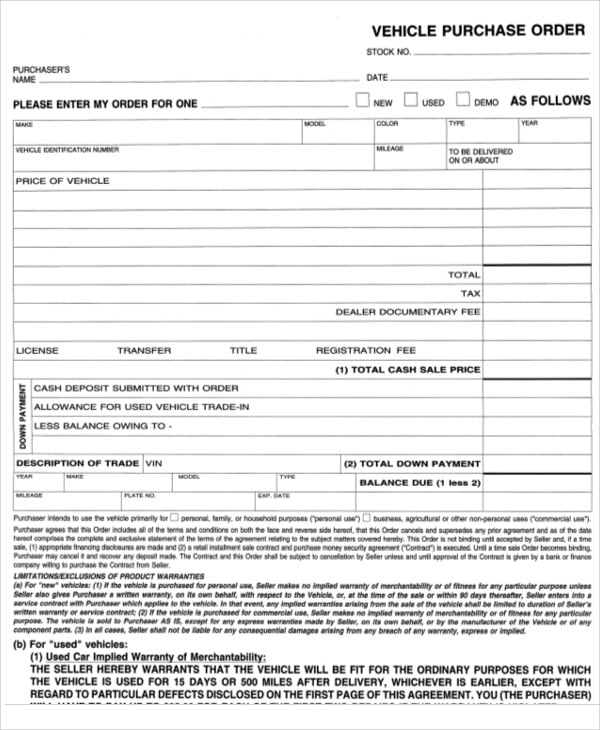

A Vehicle Lease Agreement is a document used to reflect a contract made between a vehicle owner, known as the Lessor, and someone who pays the owner to possess and use the vehicle for a predetermined period of time, known as the Lessee. A Vehicle Lease Agreement is most commonly used with new and pre-owned cars, trucks, and motorcycles. However, the agreement may also be used with any other motor vehicle that has a Vehicle Identification Number (VIN) and license plate. Using a Vehicle Lease Agreement protects both parties from any misunderstandings or miscommunications that may arise during the life of the lease by providing written documentation of the lease terms.

Vehicle Outlines Free Vehicle Wrap Templates Illustrator

Specify the status of the title. The title should be a clear title, meaning it should be free from liens for car loans or many other legal cases against the owner. For a vehicle with a financed plan, request the finance company for a payoff letter. The latter will provide you an exact balance the seller still owe on the vehicle. Standard motor vehicle bill of sale. Use this accessible standard bill of sale form template to document a vehicle sales transaction.

How to use this document

This document contains all of the information necessary to create a thorough and complete vehicle lease. The document contains pertinent identifying details, such as the Parties' respective addresses and contact information. It also includes the most important characteristics of the agreement between the Parties, such as a full description of the vehicle, any fees the Lessee will be required to pay upon signing the lease (e.g. down payment, security deposit, registration fees, etc), retail value (and, if applicable, negotiated value) of the leased vehicle, Lessor's interest rate that will be charged, and the projected value of the vehicle at the end of the lease. Finally, the agreement outlines the payment schedule and amount the Lessee will be required to pay to adhere to the agreement, as well as any possible late fees if payments are not made on schedule.

After inputting the required information, the Agreement is printed out and signed by both Parties, and then kept on file by both Parties for the duration of the Agreement as well as for a reasonable period of time thereafter.

Applicable law

Vehicle Lease Agreements, like other Lease and general purpose Sale Agreements, in the United States are generally subject to both federal law and specific state laws, which cover general contract principles like formation and mutual understanding. Federal law dictates that a Vehicle Lease Agreement must include a disclosure by the Lessor of the vehicle's odometer reading at the time of the leasing. Further, state laws cover commercial transactions and business. For example, in Louisiana, Maryland, Nebraska, Wyoming, and West Virginia, a Vehicle Lease Agreement must be certified by a notary.

How to modify the template

You fill out a form. The document is created before your eyes as you respond to the questions.

At the end, you receive it in Word and PDF formats for free. You can modify it and reuse it.

A company vehicle policy, or company vehicle use agreement, establishes which employees are eligible for a company fleet vehicle. It also outlines the requirements for qualifying for a company car, basic rules employees must follow when using company vehicles, and disciplinary action for misusing vehicles.

Special OfferTry Betterteam for FREESend jobs to 100+ job boards with one submission

Post Jobs for FREEDownloadable Company Vehicle Policy

Download this free company vehicle policy template and tailor it to your company's needs. Instant download, no email required.

Download PolicyCompany Vehicle Policy Template

1. Driver policy overview.

The [company name] company vehicle policy gives employees guidelines for obtaining, qualifying for, and using a company vehicle. A “company vehicle” is any vehicle [company name] assigns to employees. This policy applies to all employees who use a company vehicle, and applies during and outside of working hours.

2. Qualifying for a company vehicle.

Employees may qualify for a company vehicle if they drive [number] miles or more per year for work purposes, need a company vehicle for their daily work, or are supposed to receive the use of a vehicle as a benefit.

If you have not been assigned a company vehicle and believe you need one, contact HR.

To be eligible for a company vehicle, employees must complete a form and submit a copy of their driver’s license. Employees are only allowed to drive a company car if they have a valid driver’s license and a clean driving record for at least [X years].

A clean driving record means the employee has not been held at fault for a car accident or arrested on charges of violating vehicle and traffic laws.[Company name] can assign and revoke access to company vehicles at its discretion.

3. Company vehicles for employees with disabilities.

[Company Name] will make reasonable accommodations to facilitate company vehicle use for eligible employees with disabilities.

4. Personal use.

[Company name][does not allow/on a case-by-case basis allows] personal use of company vehicles. Personal use includes using the vehicle for personal errands between business activities, to commute between the workplace and home, or using the vehicle outside of business hours. [All work safety rules continue to apply when a company vehicle is used for personal purposes.]

5. Company driver rules.

- Obey traffic laws in your jurisdiction and be courteous toward other drivers.

- Document driving expenses.

- Monitor gas, tire pressure, and fluid levels.

- Report any damage or problems to your assigned vehicle immediately.

- Report changes to your driver privileges, such as driver’s license suspension, immediately.

- Always lock company cars.

- Bring vehicle to scheduled maintenance appointments.

- Do not drive while intoxicated, fatigued, or on medication that affects your driving ability.

- Do not smoke in any company vehicle.

- Do not lease, sell, or lend a company vehicle.

- Do not use a phone or text while driving.

- Do not allow unauthorized drivers to use a company vehicle unless required by an emergency.

Employees who violate company vehicle rules are subject to disciplinary actions which may include verbal and written warnings, suspension of vehicle privileges, termination and legal action.

6. Accident procedures.

In case of an accident, contact the HR department immediately. They will contact the insurance provider. Follow legal guidelines for exchanging information with other drivers and report the accident to local police if required. Do not guarantee a payment or accept responsibility without company authorization.

7. The company's responsibilities.

- Ensuring vehicles are safe before assigning them.

- Scheduling regular maintenance.

- Providing car insurance.

- Retiring and replacing cars as needed.

8. What the company is not responsible for.

- Paying fines that employees receive while driving company vehicles they are responsible for.

- Posting bail for employees who are arrested while driving cars from the company fleet.

How to Calculate Company Vehicle Personal Use:

When an employee uses a company vehicle for personal use it is considered a taxable fringe benefit. Personal use includes commuting to or from work, running errands, or allowing a spouse or family member to use the vehicle.

There are several ways to calculate personal use:

General valuation – This refers to the price the employee would pay to lease the vehicle for the same length of time in the same geographic location.

Annual lease valuation – Determine the fair market value of the vehicle by multiplying the annual lease value by the percentage of miles driven for personal use.

Cents-per-mile rule – Multiply the number of personal miles driven by the standard mileage rate of $0.58 per mile (as of 2019). If you don't provide fuel, reduce the rate by 5.5 cents.

Commuting valuation – Determine the value of a vehicle by multiplying each one-way commute by $1.50.

For more information, refer to the IRS Employer's Tax Guide to Fringe Benefits.

More Policies:

- Bereavement Leave Policy.

- Cell Phone Policy.

- Company Credit Card Policy.

- Company Travel Policy.

- Company Vehicle Policy.

- Conflict of Interest Policy.

- Cyber Security Policy.

- Dress Code Policy.

- Paid Time Off Policy.

- Social Media Policy.

- Telecommuting Policy.

- Overtime Policy.

- Attendance Policy.

- Expense Reimbursement Policy.

- Sexual Harassment Policy.

- Remote Work Policy.

FAQs:

What is a vehicle policy?

A company vehicle policy, also known as a company vehicle use agreement, determines which employees are eligible for a company fleet vehicle. It also includes requirements for qualifying for a company vehicle, basic rules employees need to comply with when using company vehicles, and disciplinary action for misusing vehicles.

Who pays when an employee gets a ticket in a company car?

Companies are responsible for tickets if they are issued against the vehicle. If they are issued to an employee, that employee is responsible for paying.

Can anyone drive a company car?

No, employees need to meet certain criteria to qualify for a company vehicle. For instance, they need a valid driver’s license and a clean driving record for a certain amount of time, to start with.

Can employees use company vehicles for personal means?

Allowing employees personal use of a company vehicle is a liability for companies, but it's also a perk that helps attract and retain employees. Companies should state in their vehicle policy whether personal use is allowed, and that company safety rules continue to apply during personal use time.

What is a company driver safety policy?

A driver safety policy outlines specific rules for people using cars owned by a company or organization. These often mandate regular maintenance on the vehicles, the use of seatbelts, and ban the use of cell phones, alcohol, and medications that impair driving ability.

Can I write off my car as a business expense?

According to the IRS, if you use a vehicle for business purposes only, you may deduct its entire cost of operation, subject to limits. If you use the car for both business and personal purposes, you can only deduct the cost of its business use.

Related Articles:

Company Credit Card Policy

Company Credit Card Policy Overview & Sample TemplateVehicle Templates Free Download

Employee Evaluation

How to Conduct an Effective Employee Evaluation.Expense Reimbursement Policy

Includes a free sample and frequently asked questions.

Includes a free sample and frequently asked questions.Remote Work Policy

Learn more about what a remote work policy is and how to create one.Employee Information Form

Free Vehicle Outline Templates