Profit and loss template is obtainable here for free and can be used to access the financial position of a business, company or organization in mentioned period of time. Profit and loss statement is one of the fundamental financial statements and lists down overall sales and expenses of the business or company. When it comes to make a profit and loss statement you will definitely need a proper format or layout to complete it with successfully that is the reason we are offering here a free profit and loss template to download that can be used for all types of businesses and companies.

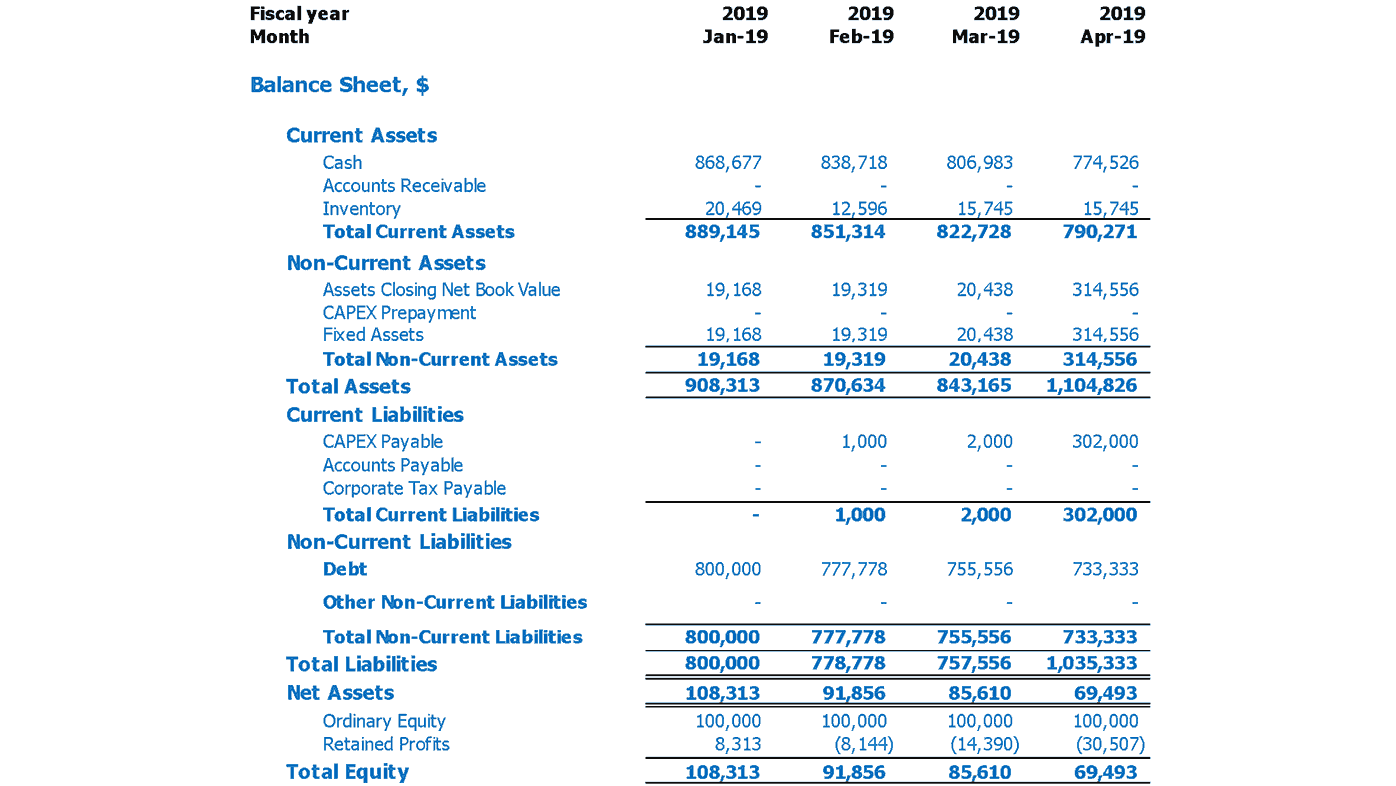

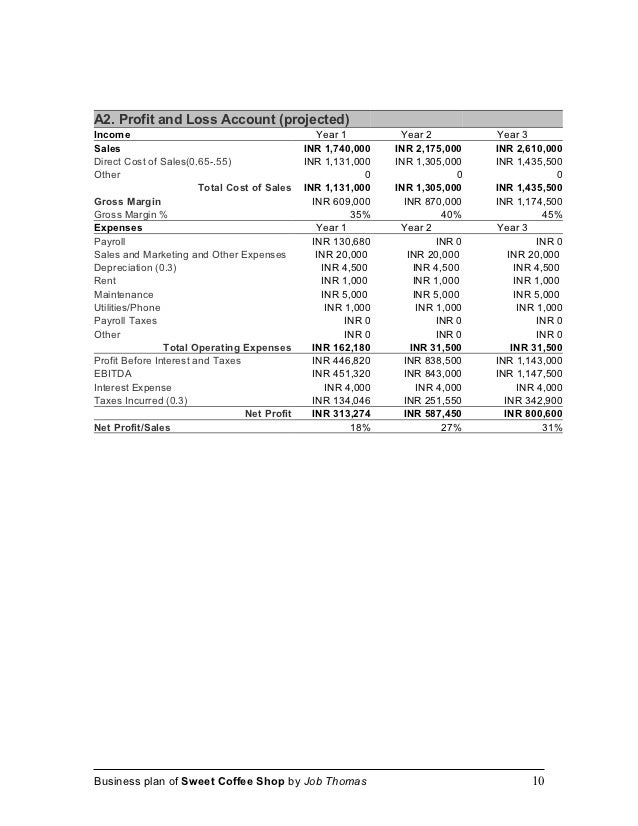

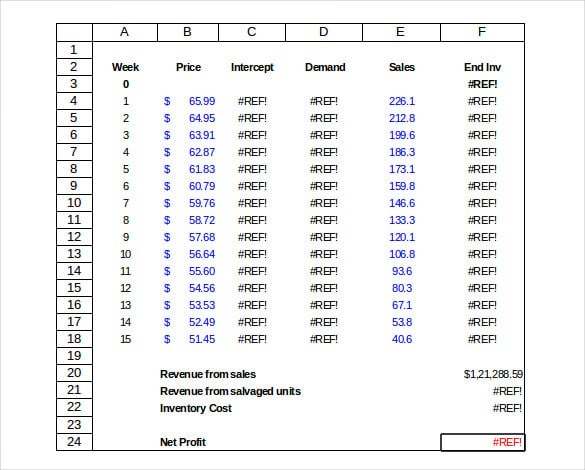

Just plug in revenue and costs to your statement of profit and loss template to calculate your company’s profit by month or by year and the percentage change from a prior period. You’ll find profit and loss templates in Excel are easy to use and configure to any business in minutes—no accounting degree necessary. The Coffee Shop financial plan includes all required forecasting reports, including assumptions, Pro Forma Income Statement For Startup (Profit And Loss Proforma), Cash Flow Statement Proforma, balance sheet, performance KPIs, and financial summaries for months and years (incl. Numerous graphs and KPIs). Coffee shop expenses sheet contains drop-down menus makes categorising expenses very quick & straightforward Provides you with a detailed coffee shop trading profit & loss account 3 spreadsheets are included: one designed for the special flat-rate retail VAT scheme, one for the retail cash VAT scheme and one for non-VAT registered coffee shops.

Importance of profit and loss templates:

Profit and loss statement is a handy accounting and financial tool to record revenues and expenses of the business or company and tells you the profit or loss of your business in results for a given time period. A profit and loss statement may have different names or titles such as profit & loss, P&L statement, income statement, statement of revenues and expenses or statement of profit and loss. Profit and loss statement’s making period could be an accounting year, quarter year, half year or three months as per policies and system the business or company is using.

Data available in profit and loss statement helps the business management a lot in decision making process when it comes to improve, expand or develop the company. Understanding the profitability of a business or company is vital for many other reasons and only possible with a carefully made profit and loss statement. Sole proprietor and small businesses are not liable to make profit and loss statement by law but making one could be beneficial for them. Profit and loss template is just one click away from you so just hit the download button and save profit and loss template in your computer.

Download Free Profit And Loss Templates Here

Profit And Loss Statement Sample

Excel Profit And Loss Statement

Profit And Loss Excel Template

Profit And Loss Statement Example

Profit And Loss Statement Examples

Monthly Profit And Loss Statement

Annual Profit And Loss Statement

Profit And Loss Statement Free Template

Profit And Loss Statement Spreadsheet

Profit And Loss Statement For Twelve Months

Yearly Profit And Loss Statement

Coffee Shop Profit And Loss Template Word

A profit and loss statement is an important way of working out not only how your business has been performing in the past, but for predicting how it will perform in the future. It can be valuable in helping you create an annual income projection, and can be used to help show investors and creditors why they should get on board with your business.

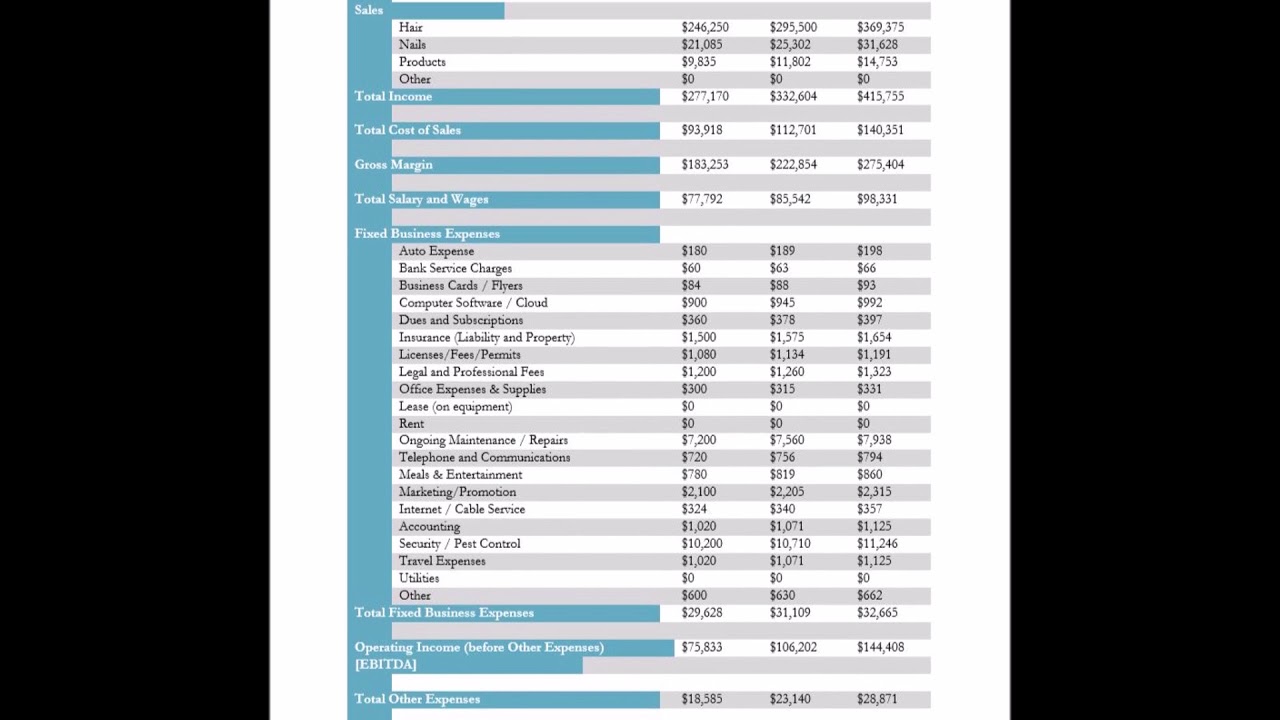

This spreadsheet can record income from up to four different products or services, so can be used in a variety of areas. For restaurants, which have slightly different sales and expenses to other businesses, please see the specific restaurant profit and loss statement we have created. It is designed to work over a year, with four columns for entering data over each of the four quarters. Should you require a projection covering a longer period of time, this can always be altered to show data for whole years, rather than quarters, simply by changing the text. Please see our balance sheet spreadsheet if it is a balance sheet, rather than profit or loss statement that you require.

Profit and Loss Statement

for Excel® 2003+Microsoft Excel® 2003 or Higher (PC & Mac)

Not Required

User License Agreement

Description

There is space on the spreadsheet to enter everything you need in order to create a profit and loss statement. The only information you need to fill in is the white cells, where data from each quarter should go. The spreadsheet will automatically calculate percentages and totals based on this information.

Coffee Shop Profit And Loss Statement

Income

The income section allows you to keep track of any money you are bringing in through sales of your products and services. Names of your individual products and services can be entered in column B (in place of the Product/Service 1) text, simply by clicking in the cell and typing over it.

Your gross profit will be calculated automatically once you enter your sales revenue and cost of sales data.

If you receive any non-operation income, for example rental or interest, fill this out below, as this will be used to calculate your total income.

Your total income will be calculated by adding both your sales revenue and non-operation income, minus your cost of sales.

Expenses

The expenses section is split into two main parts: operating expenses and non-recurring expenses. The spreadsheet will combine all of this information and give you a total of your expenses. The operating expenses section is split into 3 subsections, making it easier to fill in. Each of these subsections has space for you to add up to 2 additional expenses in the Other expenses (specify). As with the products and services, this information can simply be typed over.

The marketing and advertising section covers things such as standard advertising and direct marketing.

The development section allows you to record details of expenses including technology licences and patents.

The administrative section is the biggest of the 3 subsections, allowing you to record everything from wages through to office supplies and building maintenance.

It is important to keep track of your non-recurring expenses separately, as when it comes to analysing the data in your profit and loss statement, if you have made a loss, or the profit margin is poor, it is easy to see how much you spent on things like computer software and hardware that is unlikely to need replacing for several years.

Taxes

The amount of tax paid varies by country, and in many cases even by region within the country. This spreadsheet therefore does not try and calculate the tax you have paid, rather there is space for you to fill out all of your tax information, covering income taxes, payroll taxes and real estate taxes. There is also space for you to specify and enter details of any other taxes that apply to you.

Net Income

There is nothing to be filled out in the net income section of the spreadsheet. It simply takes your total income, and subtracts all of your expenses, including taxes.

Share Distributions/Dividends

Depending on how your business has been set up, you may take dividends as an owner or shareholder instead of, or in addition to your wages. This information needs to be filled in so that the spreadsheet can calculate your net profit correctly.

Net Profit

As with the net income section, there is nothing here to be filled out. The spreadsheet takes your net income, minus any share distributions and dividends to calculate your net profit, both in terms of actual numbers and as a percentage of your sales. If you have filled in information for more than one quarter, this will be added together in order to create a total for the year so far (Year to Date). These details are useful for creating a financial plan projection.